The Trump Tariffs: Why Blanket Policies Fail in Global Trade

Areas of Focus

- The Problem with Blanket Tariffs

- Understanding the Complexity of Global Supply Chains

- Case Studies: How Tariffs Impact Different Industries Unequally

- Market Reactions and Economic Consequences

- A Smarter Approach: Industry-Specific Tariff Strategies

- Why Precision Beats Blanket Policies

Introduction: The Problem with Blanket Tariffs

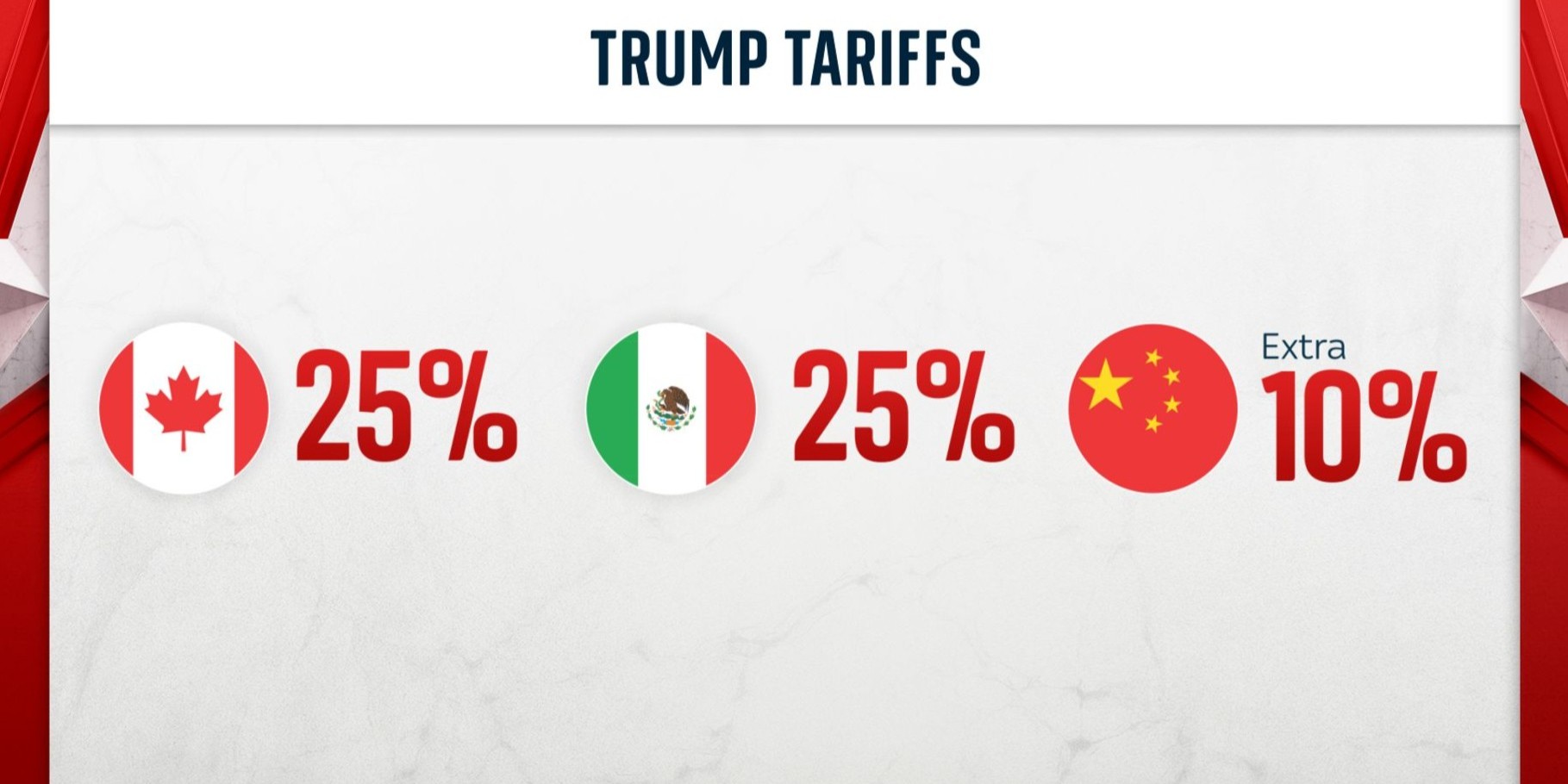

The President of the United States, Donald J. Trump, seems determined to impose blanket Tariffs on America’s main trading partners: Canada, Mexico, and China. While many reasons for the tariffs have been stated by the Trump Administration, the most consequential reason is centered around bringing manufacturing and, as a result, Jobs back to the United States of America. This is already a questionable premise as America decided, decades ago, to become a service-based economy and allow manufacturing to be outsourced to countries that can make the products at a high quality for a fraction of the cost (eg, Apple’s designed in California and assembled in China practice).

Nonetheless, even if we assume that bringing manufacturing jobs back to the US will have a positive outcome, the question of whether imposing blanket 25% tariffs on all products from Canada and Mexico is a reasonable approach. The fact that the President has had to either push the taxes to be imposed later or pardon certain sectors like the automotive sector shows that the implementation strategy was not well thought out and might not be as simple as just implementing blanket taxes.

It is also important to state that according to various studies including one carried out by taxfoundation.org, there is a near-complete pass-through of tariffs to U.S. importers and consumers. This means a 25% tariff on a product will result in a price increase of nearly 25% for that product to the consumer. Other studies including one published in the Journal of Economic Perspectives and another carried out by economists Mary Amiti, Stephen J. Redding, and David E. Weinstein showed that the tariffs implemented in 2018 increased the prices of affected imports by approximately 10% to 30%, aligning closely with the tariff rates imposed.

Researchers found that U.S. firms and final consumers bore the entire burden of the tariffs, leading to a net economic loss of $16 billion annually.

To understand the weaknesses of this strategy and come up with a better approach, it is important to consider how the tariffs will disrupt established supply chains.

Understanding the Complexity of Global Supply Chains

As a result of globalization and an understanding of comparative advantage, countries have naturally formed complex and intertwined trading relationships. These are driven by policymakers passing policies that facilitate trade and businesses and companies making strategic decisions to manufacture certain components or products in certain geographical locations that span country borders in many cases. For example, Ford produces certain models like the Ford Explorer domestically and produces other models outside the US like the Ford Bronco Sport which is produced in Mexico.

The decisions to produce certain models in certain locations are based on strategic approaches based on: the demand for certain models in certain markets, manufacturing in locations close to the sources of raw materials and input components to reduce lead times and facilitate Just-in-Time production practices, strategic partnerships, achieving economies of scale, etc. In many cases, companies understand that the components and raw materials will be taxed so it is beneficial to manufacture the products closer to the raw materials because of all the benefits listed above and then pay the taxes on the finished products as they are imported into the country.

This just gives an idea of the complexity of the strategic supply chain decisions of one company in one sector and the complexity increases exponentially when you consider different companies in various sectors that are vastly different.

Case Studies: How Tariffs Impact Different Industries Unequally

Below is a list of different industries including the time it takes to set up manufacturing plants for each industry, the increase in production costs for domestic manufacturing, and the expected pass-through of tariffs to the consumers:

1. Automotive Industry

- Estimated Pass-Through to Consumers: 50% to 80% (Source: Peterson Institute for International Economics)

- Time to Establish Domestic Manufacturing: 1 to 3 years (Source: Manufacturing Dive)

- Increase in Production Costs: Estimated $400 increase per vehicle (Source: WSJ)

2. Food and Agriculture Industry

- Estimated Pass-Through to Consumers: 80% to 100% (Source: USDA)

- Time to Establish Domestic Production: 2 to 5 years depending on crop cycles and infrastructure (Source: USDA)

- Increase in Production Costs: Domestic production could increase costs by 10% to 25% (Source: USDA)

3. Textile Industry

- Estimated Pass-Through to Consumers: 40% to 60% (Source: NCTO)

- Time to Establish Domestic Manufacturing: 1 to 2 years (Source: NCTO)

- Increase in Production Costs: Estimated 20% to 30% increase (Source: NCTO)

4. Semiconductor Industry

- Estimated Pass-Through to Consumers: 70% to 100% (Source: Semiconductor Industry Association)

- Time to Establish Domestic Manufacturing: 2 to 4 years (Source: Manufacturing Dive)

- Increase in Production Costs: Domestic fabrication can raise costs by 30% to 50% (Source: Semiconductor Industry Association)

5. Electronics and Consumer Goods Industry

- Estimated Pass-Through to Consumers: 60% to 90% (Source: Consumer Technology Association)

- Time to Establish Domestic Manufacturing: 1 to 3 years (Source: Manufacturing Dive)

- Increase in Production Costs: Estimated 15% to 25% increase (Source: Consumer Technology Association)

Key Takeaways

Market Reactions and Economic Consequences

The outcome of the proposed Tariffs can be seen in the financial markets and the overall American Economy. The Dow Jones was down over 4 percent for the month up to March 7th, 2025 and the downward trend seems to be sustained. The actual share price might keep going down or go up as the markets are moved by various factors and President Trump seems to be going back on some of the taxes but there has been a clear downward trend on Wall Street as a result of the tariffs.

In addition to this, prices of various products in the United States have seen an increase in the days since the President announced his tariff plans. Prices of electronics, automobiles, gasoline, vegetables, fruit, beef, beer, spirits etc are expected to increase. The typical American family is expected to see an increase in annual costs of $1,600 to $2,000 due to the new tariffs, according to a new analysis from the Yale Budget Lab.

A Smarter Approach: Industry-Specific Tariff Strategies

The question is, If Trump is to Implement tariffs to bolster domestic production, what would be the best approach? One clear thing is that blanket taxes on Canada, China and Mexico are not a reasonable approach as they fail to account for all the complexities of the different moving pieces of the economy. A structured approach would be as follows:

Moving beyond blanket policies

The analysis in previous sections shows that blanket tariffs can not possibly be justified, especially a value as high as 25 percent. It is quite obvious that the Trump Administration needs to move beyond the blanket tariff policies and take a surgical approach that is based on the following factors:

Based on careful analysis of these factors, a long-term development and tariff implementation plan can be put in place with details about dates, tariff values, and possible rebates for specific industries. This essentially shows that a well-rounded plan is required to bolster certain industries rather than just implement blanket tariffs based on the premise that companies will move manufacturing to the US because of the tariffs. The following are key steps necessary to implement a viable tariff plan with minimal negative economic impact and political backlash.

Understanding the Diversity of US industries

As shown in the Case Studies above, different industries have vastly different supply chains and production systems with significantly different lead times. This means that different companies in all the different industries require varying timeframes to completely change their entire or large parts of their supply chains. This shows the complexity of the economy and underlines the necessity of detailed and surgical plans.

Stakeholder engagement: building a collaborative framework

Policymakers certainly have to work in collaboration with Industry leaders and various stakeholders to ensure that they do not completely disrupt industries. The recent tanking of the US stock market shows the lack of confidence of investors in the current policy-making processes.

Instead of going back and forth on the implementation of tariffs based on lobbying by certain industries or in response to negative economic outcomes but still insisting on the implementation, it is more prudent to involve all stakeholders in the planning process, create a well-carved long-term strategic plan and implement it after dotting all the i’s and crossing all the t’s. Stakeholder engagement will also give the administration an understanding of the requirements and limitations of different companies in various industries. This will result in informed policies and tariff plans.

Gradual and Staggered Implementation

As mentioned before, the implementation of a big blanket tariff on the same day makes little to no strategic sense. Therefore, based on the engagement of stakeholders and having a collaborative framework, the implementation of the tariffs needs to be gradual and staggered. The following is a brief overview of an implementation plan that would incentivize domestic production while minimizing economic shocks, diplomatic fallout, and consumer price increases. For simplicity, the analysis is made for the automotive industry as this industry involves complex supply and value chains, manufacturing systems, and logistics. As a result, this example will be simple enough to follow but complex enough to focus on most of the relevant aspects of a well-planned and staggered tariff plan.

It is also important to note that these timelines should ideally be created in collaboration with key stakeholders and should be tailor-made for each industry or each group of similar industries at the very least.

Refined Gradual and Staggered Tariff Implementation Plan for the U.S. Automotive Industry

This plan aims to encourage domestic production by implementing tariffs in a manner that compels manufacturers to localize production without merely passing costs onto consumers. The strategy focuses on imposing tariffs on fully assembled vehicles initially, followed by specific components, with timelines aligned to the practical durations required to establish domestic manufacturing facilities for these components.

Phase 1: Immediate Implementation (0 – 12 Months)

Target: Fully Assembled Passenger Vehicles

- Tariff Rate: 18% on imported fully assembled passenger vehicles.

- Rationale: Imposing a substantial tariff on fully assembled vehicles creates a strong incentive for automakers to shift assembly operations domestically. Given that the U.S. already possesses a robust automotive assembly infrastructure, this transition is feasible within the short term.

Risk Mitigation:

- Clearly define “fully assembled vehicle” to prevent circumvention by importing nearly complete units.

- Offer tax incentives for investments in U.S. assembly facilities to offset initial relocation costs.

Phase 2: Intermediate Components (12 – 24 Months)

Target: Components with Moderate Manufacturing Complexity

- Examples: Interior components (e.g., seats, dashboards), body panels, and glass components.

- Tariff Rate: 15% on these components.

- Rationale: These parts require moderate capital investment and technical expertise to produce domestically. The 12- to 24-month window allows manufacturers sufficient time to establish or expand production lines for these components.

Risk Mitigation:

- Provide grants or low-interest loans for setting up domestic production facilities.

- Implement workforce training programs in collaboration with technical schools to ensure a skilled labor pool.

Phase 3: Advanced Components (24 – 36 Months)

Target: High-Complexity Components

- Examples: Electronic control units (ECUs), advanced driver-assistance systems (ADAS) components, and electric vehicle (EV) battery packs.

- Tariff Rate: 20% on these components.

- Rationale: Establishing manufacturing capabilities for high-tech components necessitates significant investment and has longer lead times. The 24- to 36-month period provides a realistic timeframe for companies to develop domestic production facilities for these critical parts.

Risk Mitigation:

- Offer research and development tax credits to encourage innovation in domestic manufacturing.

- Facilitate partnerships between automakers and technology firms to accelerate the development of domestic supply chains for advanced components.

Phase 4: Comprehensive Review and Adjustment (36 – 48 Months)

Actions:

- Evaluate the effectiveness of the implemented tariffs in increasing domestic production.

- Assess the impact on consumer prices and overall market dynamics.

- Adjust tariff rates and policies based on empirical data to ensure objectives are being met without causing undue economic disruption.

Risk Mitigation Strategies

- Preventing Cost Pass-Through: Implement monitoring mechanisms to ensure that the tariffs lead to domestic production rather than merely increasing consumer prices. This could involve conditional tax breaks tied to domestic production milestones.

- Supply Chain Coordination: Establish a task force comprising industry stakeholders to oversee the transition, address bottlenecks, and facilitate collaboration among manufacturers, suppliers, and government agencies.

- Consumer Protection Measures: Introduce subsidies or tax rebates for consumers purchasing domestically produced vehicles to offset potential price increases during the transition period.

Expected Outcomes

- Increased Domestic Production: The structured tariff implementation is anticipated to compel automakers to localize production, thereby boosting domestic manufacturing.

- Job Creation: Establishing new manufacturing facilities for various components is expected to create employment opportunities across the automotive sector.

- Technological Advancement: Encouraging the domestic production of advanced components will likely stimulate innovation and enhance the competitiveness of the U.S. automotive industry.

This refined plan leverages factual data and realistic timelines to ensure that the tariffs are effective in promoting domestic production without causing unnecessary economic strain.

Avoiding Unintended Consequences

Implementing industrial policies requires careful consideration to prevent unintended outcomes. A discussion at the World Economic Forum in Davos highlighted the resurgence of industrial policy and its potential effectiveness. Experts emphasized the importance of clear, well-structured goals, exposure to competition, and the inclusion of sunset clauses to ensure that policies do not lead to market distortions or conflicts between policy objectives.

Additionally, the difficulty in terminating established subsidies was noted as a challenge, underscoring the need for policies that are adaptable and time-bound. Engaging stakeholders across the value chain and conducting comprehensive impact assessments can further mitigate risks, ensuring that policies achieve their intended objectives without adverse side effects.

Conclusion: A Smarter Approach to Trade Policy

The failure of blanket tariff policies lies in their inability to account for the complexity of global supply chains and the unique needs of different industries. While tariffs may appear to protect domestic jobs and industries, they often have unintended consequences—raising costs for consumers, disrupting manufacturing, and making domestic companies less competitive internationally. Instead of a broad-brush approach, a more strategic, industry-specific policy is needed—one that balances fair trade with economic competitiveness.

The future of global trade requires nuanced solutions: targeted tariffs where justified, investment in domestic innovation and manufacturing, and diplomatic negotiations that strengthen, rather than isolate, the economy. Trade policy should not be about imposing rigid barriers but about fostering resilience, adaptability, and long-term growth.

Golden Arc Consulting